On my ongoing journey of building wealth, I first had to lay out the foundation of where my mindset was regarding money, first. It was scary to really look at my current financial situation as a woman entering 40 years old soon. I didn't even realize that that was the first step towards building wealth: changing your mindset about how you currently view money. With the help of great women like Takisha Artis, I was able to do just that, first! After I became more confident in my new found positive mindset about money, I moved onto figuring out ways to tell my money exactly where to go weekly. The EASIEST way for me to do that consistently, was to create a SIMPLE budget for my weekly and or monthly expenses.

Felicia, how did you do that? Well first, I identified what my monthly expenses were/are by pulling three months of my bank statements to actually SEE where my money was going. You can't create a budget without knowing exactly where your money has gone, prior to creating a budget. Here's a great time to comb through your bank statements and cancel all of those subscriptions that you no longer use or really don't need to use, at this time in your life.

Next, I divided my expenses into the following categories:

Bills and groceries

Student loans

My Schmoney

Savings (long-term)

Sinking funds (short-term)

Credit Card debt

Currently, I have a $1,800 savings goal to pay my monthly student loan payments for a year on time. Every month, I pay extra on my student loans because I want to knock this debt off of my list......ASAPUALLY!!!! Paying my monthly payments will also help boost my credit score, which is another personal finance goal of mine for this year.

In case you're wondering, I budget for and created sinking funds for short-term savings (i.e., Christmas money for my youngest son, monthly student loan payments, splurge money, etc.). Doing this allows me to responsibly pay for things that I enjoy in life, put a smile on my son's face at Christmas and not go into debt trying to keep up with the Joneses or stressing over not having enough money to do the things that make me happy, daily.

Next, I identified my expenses categories, afterwards, I then write each bill/expense due date on my financial calendar for the month so that I can see what bills are due every week. This helps me see and know how much money I need to budget every week/pay period. Now onto the meat and potatoes of how my SIMPLE budget looks weekly but feel free to do this for yourself monthly.

Instructions: Write each category that you want or need for your weekly/monthly expenses and then add the amount that you need to budget for those categories. For example, if I earned $775 after taxes this week, this is what my budget would look like:

Bills and groceries $300

Student loans (debt) $100

My Schmoney (my money to buy what I want) $50

Savings $250

Credit card (debt) $75

This way of budgeting for me is repeated throughout each week of the month and should equal the amount of money that I bring in, after taxes. I write the amount of money for each category in pencil just in case I need to readjust my budget at any moment.` Of course these are not all of my monthly expenses. I didn't want to overwhelm you lol, but please include expenses such as rent/mortgage, gas, car note, insurance...... you get it right? Your budget categories can be as minimalists as possible to very detailed as you want it to be. There's no one correct way to budget your money. I always say, do what works best for you, your household and your household income. You may be tech savvy and prefer to use an Excel spreadsheet or an app to create your budget or you may be old school like me and prefer to use pen and paper in a notebook. Whatever you do, budget the way YOU feel the most comfortable doing it, consistently.

If you have any questions about simple ways to create a budget, let me know in the comments. Disclaimer: I am not a financial advisor, I am only providing you with information that has worked for me. Please consult with a certified financial advisor as needed.

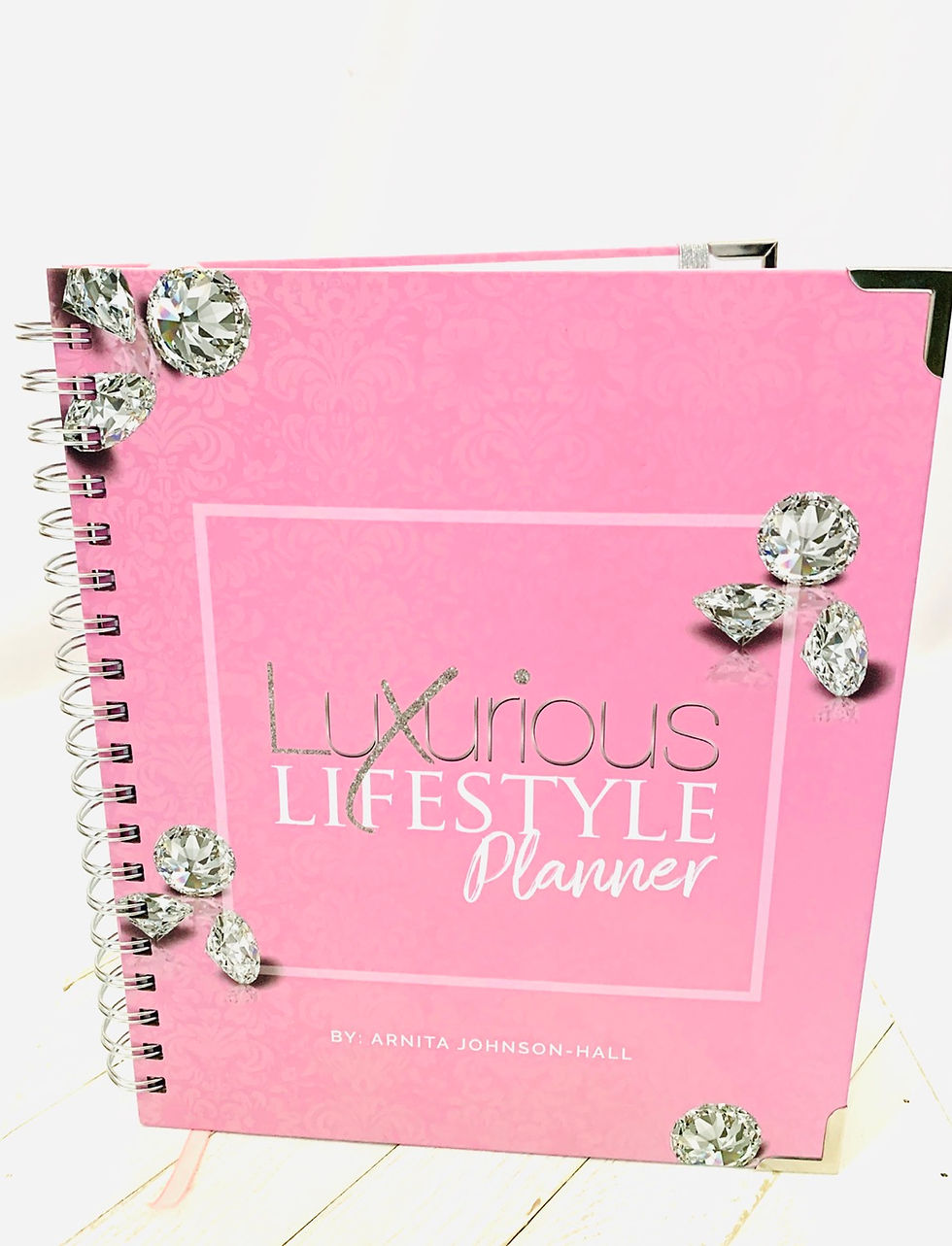

If you are looking for a planner that is tailored towards helping you get your personal finances and credit in order, look no further, click to order the Luxurious Lifestyle Planner here.

Comments